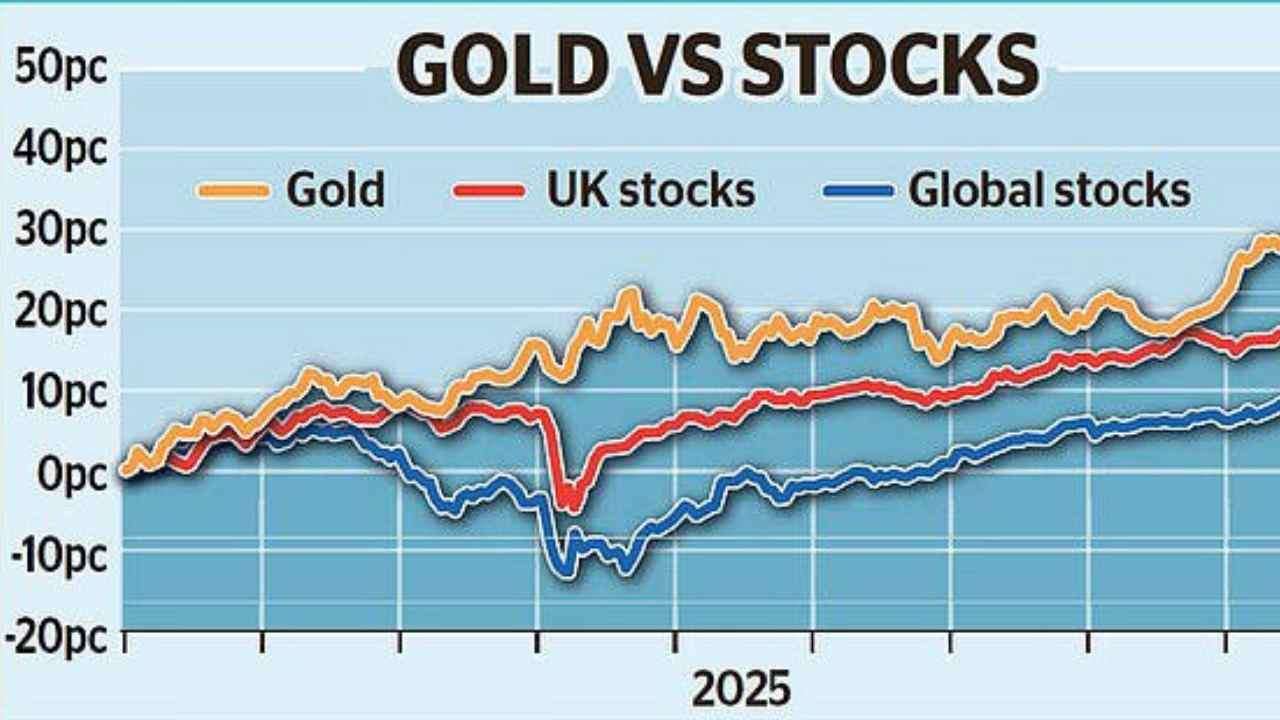

Gold has cemented its status as the investment story of the year, with the price soaring past the unprecedented 4,000 USD per ounce mark this week. The precious metal, which has rocketed by over 52 per cent since the beginning of the year and 250 per cent over the last decade, is being driven to new heights by a potent mix of geopolitical anxiety, economic uncertainty, and a palpable shift in global financial strategy. The price is currently trading near 4,040 USD per ounce.

The rally is a complex phenomenon, propelled by four main pillars:

The Erosion of Confidence in the U.S. Dollar

A primary catalyst is the deep-seated concern over the fiscal health and political stability of the United States. The ongoing U.S. government shutdown, coupled with persistent high national debt and uncertainty surrounding the Trump administration's trade and tariff policies, has significantly weakened the dollar's standing. Furthermore, the administration's repeated threats toward the Federal Reserve and challenges to its independence have fuelled concerns about the dollar being weaponized—a worry that dates back to the freezing of 225 billion British Pounds of Russian assets in 2022. This 'de-dollarisation' trade sees investors and central banks shunning the greenback in favour of gold as the ultimate hard currency.

Aggressive Central Bank Buying

A crucial, often under-reported driver is the sheer scale of buying by central banks. Emerging and major nations, including China (which has added to reserves every month for over a year), Poland, Kazakhstan, and Turkey, are diversifying their reserves away from the U.S. dollar and into gold. This less price-sensitive demand has been a structural tailwind. Experts estimate that central banks have bought over 1,000 tonnes of gold in each of the last three years (2022, 2023, and 2024), establishing a new, higher foundation for the price.

The Search for a Hedge Against Risk

In an edgy era defined by mounting geopolitical tensions (including the wars in Ukraine and Gaza) and sticky inflation, gold is the classic safe haven. The metal’s appeal is further amplified by growing apprehension over the valuation of high-flying technology stocks, particularly the so-called "Magnificent Seven" tech titans. Analysts like Thierry Wizman of Macquarie bank suggest gold's rally is a collective hedge against the potential failure of the AI-driven tech boom to justify its massive valuation and investment needs. Adding to the broad 'debasement trade,' Bitcoin has also simultaneously surged, hitting an all-time high above 126,000 USD, with many viewing it as 'digital gold' to hedge currency risks.

Expectations of Lower Interest Rates

Despite recent volatility, market sentiment leans toward the U.S. Federal Reserve cutting interest rates in the future as the economy slows. The market is currently pricing in two potential rate cuts by year-end. Because gold is a non-yielding asset, a fall in interest rates (and the lower returns on bonds and cash) reduces the opportunity cost of holding bullion, making it comparatively more attractive.

Is It Safe to Invest in Gold Now?

Given that gold is trading at unprecedented levels, the answer depends entirely on an investor’s time horizon and goals.

For Strategic, Long-Term Investors (The 'Safe' View):

The long-term structural drivers—massive central bank buying and de-dollarisation—remain intact. Gold acts as a crucial hedge against the biggest current risks: economic instability, geopolitical turmoil, and currency devaluation. Financial advisors frequently recommend maintaining a moderate, strategic allocation to gold (often 5 per cent to 15 per cent of a total portfolio) to protect real, after-tax returns. Yes, it is safe to invest, but as a portfolio diversifier.

For Tactical, Short-Term Investors (The 'Cautionary' View):

The risk of a near-term correction is high. The rapid, sharp rally suggests the market is technically "overbought." Technical indicators and analyst warnings suggest that a sharp wave of profit-taking could trigger a near-term dip, potentially testing support levels around 3,700 USD. The best strategy is to buy on dips, waiting for a temporary pullback—a "healthy" correction of 10 per cent to 15 per cent—to establish a new position.

Is It Going Higher?

The consensus among major investment banks and analysts remains firmly bullish for the medium to long term. Goldman Sachs has recently raised its price target, forecasting gold to hit 4,900 USD an ounce by the end of 2026, up from its previous 4,300 USD estimate. The 4,000 USD level is now expected to become a key support, with some analysts seeing a near-term technical target of 4,160 USD.

A fall would be triggered by a sudden, decisive resolution to major geopolitical conflicts or the U.S. government shutdown, or an unexpected change to a 'hawkish' stance from the U.S. Federal Reserve. For now, the combination of central bank demand, geopolitical fear, and the search for diversification suggests the golden rally "still has legs," according to market strategists.

.svg)