Rishi Sunak, who owns a five-bedroom mews house in Kensington, a sprawling Georgian manor in North Yorkshire, and a penthouse in Santa Monica, is no stranger to the pleasures of property ownership. In a recent televised discussion with Keir Starmer, Sunak recalled the first time he set foot in his South Ken pied-à-terre and remarked, "I want everyone to feel what I felt when I got the keys to my first flat."

Sunak reaffirmed the Tory party's unwavering dedication to real estate brokers, home builders, and the transformative potential of physical real estate when he unveiled his electoral manifesto. He said, "We Conservatives are the party of the property-owning democracy in this country, from Macmillan to Thatcher to today."

It is a familiar tune. But after 14 years of Tory rule, the prospect of home ownership has never been more distant for so many people, as house-price inflation continues to rocket far beyond wages. Two decades ago, a household with the median income could afford to buy an average-priced house in England. Now, they can afford only the cheapest 10% of properties.

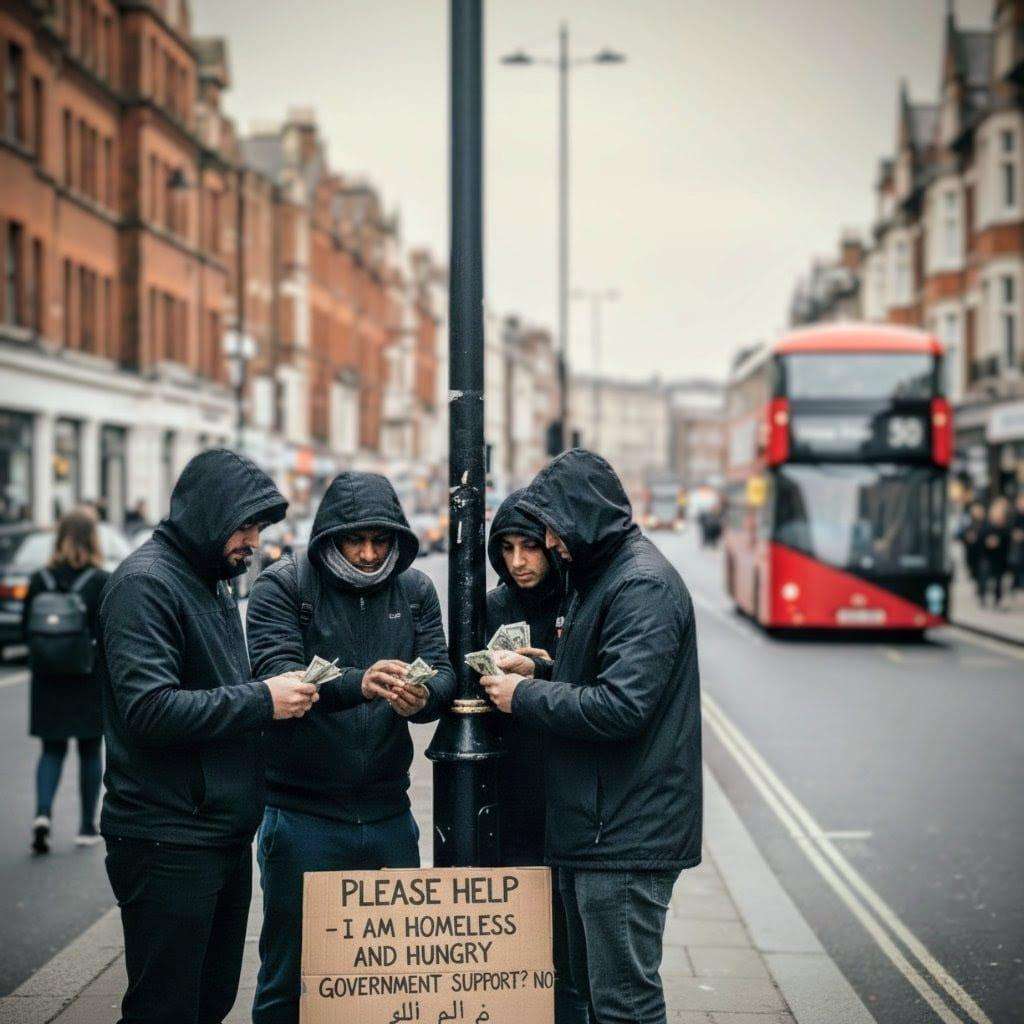

In the capital, the situation is even more absurd. An average first-time buyer in London now has to save for more than 30 years to afford a deposit on an average home. The result is ever more people trapped in the private rented sector, at the mercy of unregulated landlords and subject to rents that have reached a record high. The number of adults living with their parents has risen by 700,000 over the last decade, with about 30% of 25- to 29-year-olds now living back at home. Tory doctrine has created not a nation of homeowners, but a country of squeezed renters, overcrowded flat-sharers and rough sleepers, with the number of people sleeping on the streets more than double the figure when the Conservatives came to power in 2010.

So what is Sunak’s grand plan to fix this mess? His momentous proposal is to resuscitate the still-warm corpse of help to buy, the single policy that the government’s housing strategy has relied on for the last decade. Like a B-movie sequel to Margaret Thatcher’s right to buy, it is a policy that has defined the contemporary Conservatives’ shameful housing record more than any other. It was billed as a silver bullet to boost home ownership, but it has only served to help the already well-off, increase house prices further, and pump public subsidies straight into the pockets of the party’s favourite donor house builders. Sunak’s promise to reboot the failed policy reveals a party that has not just run out of ideas, but which is determined to continue the damage it has already done.

Help to buy was first introduced in 2013 by the then-chancellor George Osborne, and trumpeted as “the biggest government intervention in the housing market since the right to buy” of the 1980s. Over the last four decades, that disastrous policy has seen two-thirds of Britain’s council homes transferred from public to private hands, forcing local authorities to sell off more homes each year than they can build. Even the new generation of award-winning council homes is now being sold off, less than five years after they were completed. But help to buy was supposed to be different. “It’s a great deal for homebuyers,” said Osborne. “It’s a great support for home builders. And because it’s a financial transaction, with the taxpayer making an investment and getting a return, it won’t hit our deficit.” Win, win, win.

So how did it work? The policy provided first-time buyers with an equity loan of up to 20% of the value of a new-build property – or 40% in superheated London – capped at a total price of £600,000. The buyer was required to stump up a deposit of just 5%, with the remainder covered by a traditional mortgage. It was a reaction to sluggish rates of housebuilding, when developers were still licking their wounds from the financial crisis, and banks were reluctant to lend more than 75% of a new-build home’s value to purchasers, cutting many first-time buyers out of the market. The dubious logic behind help to buy was that by stimulating housing demand, housing supply would inevitably follow.

Economists balked. As Christian Hilber, professor of economic geography at the London School of Economics, wrote at the time: “Help to buy will likely have the effect of pushing up house prices (and rents) further with very little positive effect on new construction. Housing will likely become less – not more – affordable for young would-be-owners!”

Duncan Stott, of the campaign group PricedOut, was equally prescient: “Help to buy should really be called ‘help to sell’,” he wrote, “as the main winners will be developers and existing homeowners who will find it easier to sell at inflated prices. Pumping more money into a housing market with chronic undersupply has one surefire outcome: house prices will go up.”

One decade on, this is exactly what has happened.

A report published by the House of Lords built environment committee in 2022 concluded that the help-to-buy scheme “inflates prices by more than the subsidy value” and does “not provide good value for money, which would be better spent on increasing housing supply”. What began as a three-year programme worth £3.5bn ended up being extended for a full decade, and costing the taxpayer more than £29bn. The Lords rightly pointed out that the cash should have been used instead to replenish England’s falling stock of social housing.

Research conducted by Hilber and his team at the LSE found that help to buy increased house prices in London by 8%, and boosted developers’ revenues by 57% in the process. The researchers found the policy “led to higher new-build prices but had no discernible effect on construction volumes”, effects that are “arguably contrary to the policy’s objectives”. Worse still, they found that the policy actively stimulated construction “in the wrong areas”. It had the effect of catalysing out-of-town developments on greenfield sites, increasing commuting distances and car use, rather than helping to revive depressed town centres and stimulate development where employment and productivity is concentrated – where housing is needed most.

Meanwhile, the house builders reaped bigger rewards than ever. Persimmon posted pre-tax profits of more than £1bn in 2018 and 2019, a record matched by Barratt in 2022. Share prices across the industry rocketed, leading to huge bonuses for chief executives. Jeff Fairburn, the then boss of Persimmon, was notoriously awarded a bonus of £82m, one of the largest such bounties in British corporate history, and was forced out as a result. Defending his payout, Fairburn was frank about the cause of the vast sum: “It’s supply and demand, and the demand has been created through the help-to-buy scheme.”

So, who benefited at the other end? Did the policy really help to mint a new generation of homeowners, who wouldn’t have otherwise been able to get a foot on the housing ladder? In total, the government says the scheme helped about 330,000 first-time buyers purchase a home, before it was axed in October 2022. But it seems the majority of beneficiaries were not the most needy. According to the housing charity Shelter, the government’s own evaluation of the policy showed that only two in five help to buyers actually needed the programme to purchase a home. The majority used the subsidy to buy bigger and more expensive properties than they could otherwise have bought. Figures showed that the average salary of a first-time buyer using help to buy was £50,000, 85% more than the typical private renter household. Only 19% of privately renting households earned that much, according to Shelter.

Helping out the comfortably-off and lining the pockets of developers may have been a calculated part of the Tory policy. But help to buy has also had a major unintended consequence: leaving many buyers trapped in negative equity. When a home bought using the scheme is sold, the government gets 20% of the property’s value based on its sale price, rather than the cost when the owner first bought it. Market stagnation, or a fall in value, can therefore leave buyers unable to move.

A 2020 investigation by the consumer group Which? found that one in seven homes bought using help to buy had lost value, despite booming local property markets. Research by the estate agent Hamptons last year found that people who bought a new-build home were twice as likely to sell it on at a loss than second-hand homeowners. This is a consequence of help to buy having created massively inflated premiums on new-build homes – which quickly evaporated once the home had been lived in (and the shoddy reality of much new-build construction was discovered). The market distortion was particularly evident in flats, which are more likely to be bought by first-time buyers. Before help to buy was introduced, the premium on new-build flats was 5%, according to the property data company TwentyCi. By 2018, it had reached 37%, and by 2022, it had shot up to 65%. That’s a lot of new-build flat owners who, also thanks to cladding scandals and ballooning service charges, will be locked into their poorly built towers for years to come.

.svg)