“Modern fiat money and reserve banking is indeed a manifestation of the transmutative ‘nothingness’ of the Philosophers’ stone, for from the creation of credit out of nothing, gold is produced.” - Joseph P. Farrell

The mystical Philosphers' Stone, the legendary substance that transforms base metals into gold, is a concept in alchemy that has fascinated our greatest minds throughout the history of mankind. Alchemists, practitioners of the occult, believe that the Philosophers’ Stone not only transforms base metals into gold but also serves as the elixir of life that grants immortality. While the literal or symbolic nature of the Philosophers’ Stone remains debated, eminent philosophers, mathematicians, astronomers, theologians, occultists and scientists alike have pursued it tirelessly throughout history; for them, it was real. Newton for example pursued science during the day, and alchemy during the night. The father of modern physics held occult beliefs—a notion that may seem peculiar in our time, yet it holds as much truth as the apple falling from the tree due to gravity.

Joseph P. Farrell's proposition in his book "Babylon’s Banksters: The Alchemy of Deep Physics, High Finance and Ancient Religion," that the creation of credit from nothing mirrors the Philosophers’ Stone, is a profound philosophical discussion with significant real-world implications. To grasp his argument, we need to ask a few questions first. Can you purchase gold with money? Yes. Can you purchase gold with something that lacks intrinsic value? No. So why is it that money created out of nothing, not backed by anything that has intrinsic value, can still be used to buy gold?

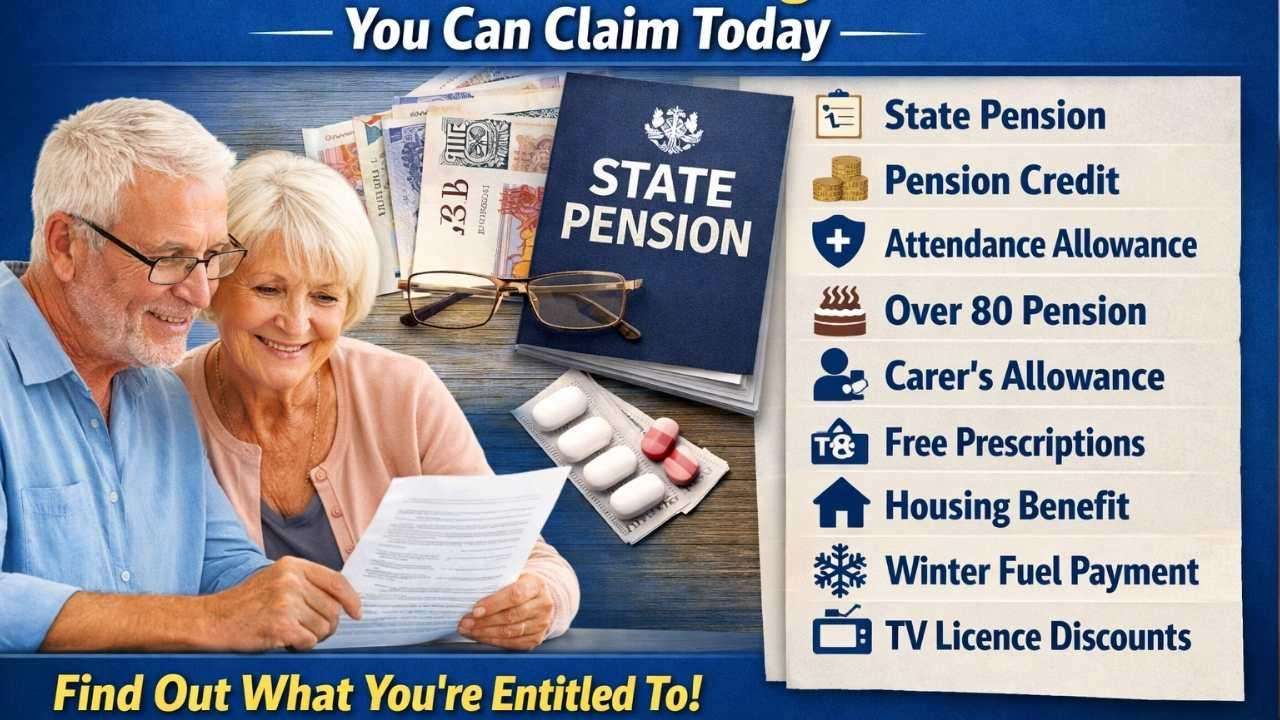

In order to understand what Farrell is talking about, we need to discuss "Fractional ReserveBanking," a global system where banks hold only a fraction of deposits as reserves and lend out the rest. This system effectively creates money from nothing, akin to the alchemical concept of the Philosophers’ Stone, which transforms base metals into gold. This idea may seem fantastical or "magical," but it accurately describes the mechanics of modern banking practices.

In simple terms, if you deposit money in a bank, the bank might be required to retain 10% in reserve and can loan out the remaining 90%. For example, if you deposit $100 in the bank, the bank retains $10 and can lend out $90. Suppose someone borrows this $90 and spends it. The recipient of the $90 deposits it back into the bank, which then keeps $9 (10%) and loans out $81. Thus, from your initial $100 deposit, the bank has effectively created an additional $90 + $81 = $171 in loans, adding to the money circulating in the economy. Theoretically, the total amount of money that can be created or loaned out starting from an initial deposit of $100 in this system is infinitely larger than the original deposit, as each subsequent deposit and loan cycle continues to multiply the money supply under the fractional reserve system; the bigger the deposit the worse it gets. A never ending debt cycle is thus created. Banks are essentially making money out of your money, and everytime you deposit money in the bank, you contribute to inflation.

If you believe you can outpace inflation by depositing money in banks and earning a fixed interest rate, you may be mistaken. Typically, the interest rates offered by banks are lower than the inflation rate; remember banks never lose. For example, if your bank offers a 4% interest rate on your deposit, but the inflation rate is 5%, you would end up with $104 at the end of the year. However, due to inflation, the real value of your money has decreased, effectively resulting in a loss of purchasing power despite the interest earned. This system is designed so that simply saving money in a bank is unlikely to beat inflation. To truly outpace inflation, investing in commodities or assets that have historically appreciated in value might be necessary.

The numbers in your bank account are simply that—numbers. Only about 10% of all money exists as physical cash; the remaining 90% is just digital data, represented as 0s and 1s in a computer. They claim this system lowers the cost of creating money, enhances security, and saves time since physical cash requires transportation. But the question is, “If it costs nothing to create money, how does it have any value? With a few keystrokes, you change a few digits on your computer, and now I can buy real goods using it because you say so?” This is why ATMs run dry during bank runs—there is no physical money available.

Financial institutions have ingeniously crafted ways to showcase the supposed success of this system. How do we know it works? Just take a glance at our "booming" economy—have you seen the charts? They only go up, without a hint of descent in sight. Likewise, the chart tracking debts exhibits a remarkable consistency—it, too, climbs ever higher. It's almost as if there's a magical formula at play: the more debts accumulate, the more robust our economy appears. Who needs gravity when you have endless growth, fueled by debt and digital digits?

If there were a printing limit, such as a gold standard, it would be logical, but there isn't one. Inflation in this system is perpetual because money can be printed out of thin air. The more money is printed, the less valuable it becomes. From 1950 to 2024, the U.S. dollar has gracefully depreciated by a mere 1200%. That means your grandpa's $1 is now worth enough to buy you a decent cup of coffee! So, remember folks, saving money today is just another way to watch it shrink tomorrow.

So we return to our starting point, the Philosopher’s Stone. It appears that it does exist, masquerading under the euphemism of "Fractional Reserve Banking." Through this alchemical process of creating money out of thin air, value is conjured. After all, what is gold but a store of value?

To be continued..

.svg)