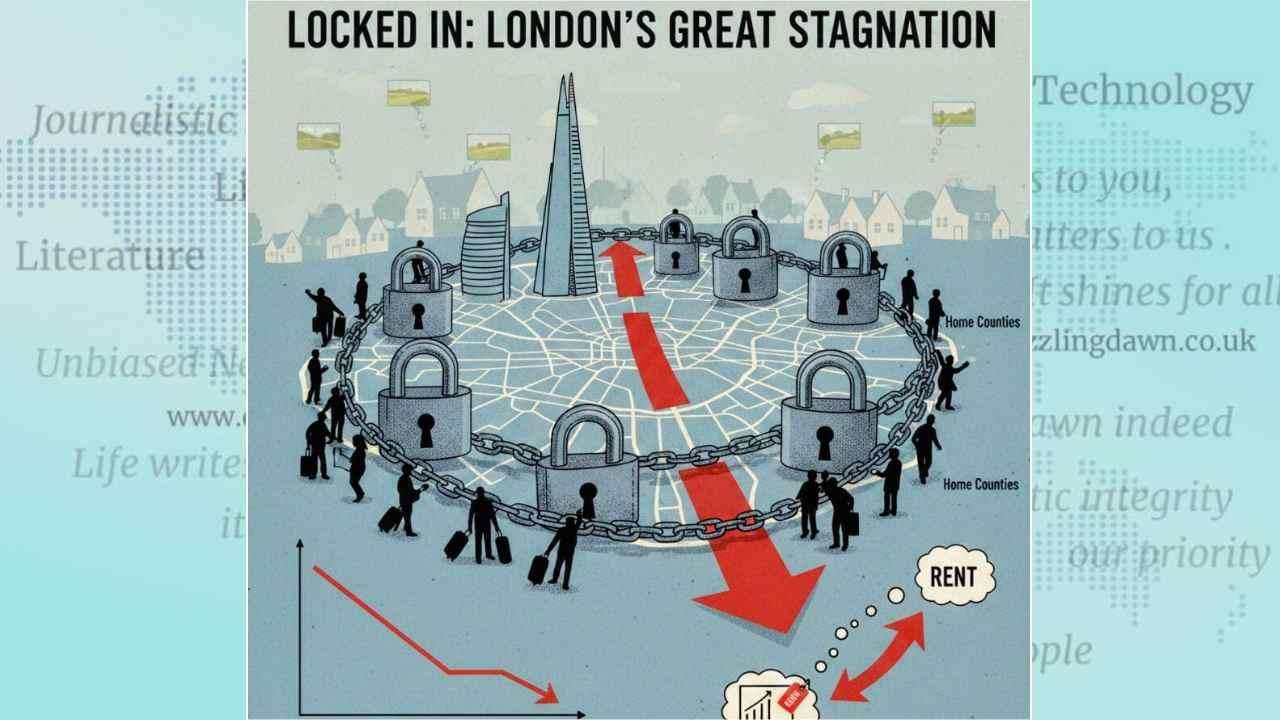

The era of the "race for space" has officially hit a dead end. In a dramatic reversal of the post-pandemic flight to the countryside, the number of Londoners migrating out of the capital has plummeted to its lowest level in over a decade. Recent data reveals that Londoners accounted for a mere 5.6% of home purchases outside the city this year, a sharp decline from the 8.2% peak seen in 2022. This shift represents more than just a change in scenery; it signals a fundamental restructuring of the UK property hierarchy where the capital is no longer the undisputed engine of national price growth.

The primary catalyst for this domestic paralysis is a pragmatic recalculation of value. For the better part of a decade, the price gap between a London terrace and a country estate was vast enough to justify a grueling commute. However, with London house prices stagnating—rising just 8% over the last five years compared to a 26% surge in the regions—the financial incentive to flee has evaporated. In high-value enclaves like Kensington and Chelsea, average prices have corrected by as much as 16.5% in a single year. For many homeowners, the equity required to fund a move to the Home Counties simply isn’t there anymore, particularly as the broader London market saw its fastest price contraction in nearly two years following fiscal uncertainty surrounding the recent Budget.

Corporate culture is also playing a decisive role in tethering residents to the M25. As the novelty of full-time remote work fades, the "return-to-office" mandate has transformed the 100-mile commute from a minor inconvenience into a career deal-breaker. Those who do manage to leave are no longer venturing into the deep countryside of Cornwall or the Cotswolds; instead, they are clustering in "buffer zones" like Surrey and Hertfordshire. Proximity to the office has once again become the ultimate luxury, and for those unable to bridge the gap, staying in the capital has become a matter of professional necessity rather than lifestyle choice.

The impact on London’s internal ecosystem is profound, particularly for the rental market. As fewer people move out to buy their first homes elsewhere, the "exit door" of the rental sector has effectively locked. This lack of churn is creating a pressure cooker environment for tenants. With potential buyers staying put in rented flats due to affordability constraints and limited stock, rental prices are facing upward pressure even as sales prices soften. The capital is increasingly becoming a city of long-term renters, as the traditional ladder from a London flat to a suburban house loses several rungs.

Furthermore, falling mortgage rates have paradoxically acted as a tether. While lower rates usually encourage movement, they have currently made it just affordable enough for some households to remain in the city or move only a short distance, rather than being forced to chase affordability hundreds of miles away. Looking forward, the "country manor" dream appears to be on indefinite hiatus. With property experts predicting limited equity gains in the capital over the coming years, the financial bridge to the regions remains broken. London is no longer just a place to start a career; for an increasing number of residents, it is becoming the place they simply cannot afford to leave.

.svg)