The Rising Cost of Living and the Stealth Tax Trap-A growing "fiscal drag" is set to pull an additional 35,000 British families into the High Income Child Benefit Charge (HICBC) net over the next three years. According to the latest data from HM Revenue and Customs, the number of households required to repay their benefits is projected to climb to 359,000 by the 2028-29 tax year. This surge is largely driven by frozen tax thresholds; as wages rise to keep pace with inflation, families find themselves classified as "high earners" even if their real-world purchasing power has not improved. Currently, the charge is triggered when one parent earns more than £60,000, with the benefit being completely clawed back once income hits £80,000. Many parents remain unaware they owe this money until they receive unexpected demand letters from HMRC, as the calculation includes "hidden" income such as savings interest and dividends, Daily Dazzling Dawn understands.

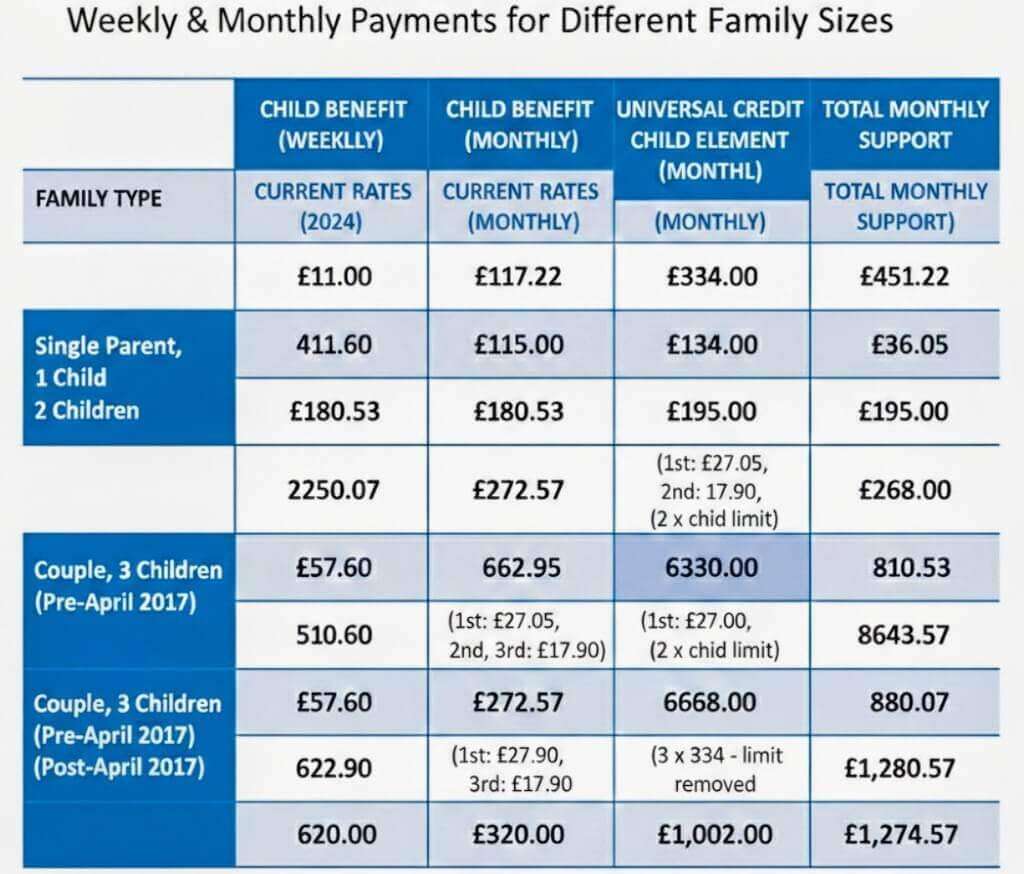

Universal Credit and Child Benefit Surge for April 2026-The Department for Work and Pensions (DWP) has confirmed a significant financial boost for millions of claimants starting this April. Most working-age benefits, including Universal Credit and Child Benefit, are set to rise by 3.8% in line with the September CPI inflation figure. For Universal Credit claimants, the standard allowance will see an even larger boost of approximately 6% due to the Universal Credit Act 2025. This means a single person over 25 will see their monthly payment rise from £400.14 to £424.90. Child Benefit rates are also increasing: families will now receive £27.05 per week for their eldest child and £17.90 for each additional child. These increases represent a vital lifeline as the government attempts to mitigate the ongoing pressures of high household costs.

The Historic End of the Two-Child Limit-In a landmark policy shift effective from April 2026, the government is officially scrapping the controversial two-child limit on Universal Credit. Previously, families could only claim the "child element" for their first two children, a policy widely criticized for driving up child poverty rates. Under the new rules, families will be eligible for an additional £3,647 per year for every child in the household born after April 2017, regardless of the total number of children. Projections suggest this change will lift 450,000 children out of relative poverty by the end of the decade. Additionally, the maximum help available for childcare costs will increase by over £700 for each child beyond the previous two-child cap, providing substantial relief for larger working families.

Potential Reform: What Changes if a New Power Takes Over-The political landscape regarding benefits remains a major point of contention, particularly with the rise of Reform UK. While the current government moves to lift the two-child cap for all, Reform UK has signaled a different approach, suggesting they might oppose a universal lift of the cap. Leadership within the Reform party has previously indicated they would prefer the benefit changes to prioritize "British-born" families, a stance that has sparked intense debate in Parliament. Furthermore, there is a looming discussion regarding the HICBC itself. While the previous administration considered moving the tax charge to a "household income" model—to stop punishing single-earner households—the current government has stalled this reform. If a party like Reform or a more conservative coalition gains further influence, we may see a renewed push to change how "high income" is defined, potentially shifting the burden away from individual earners and toward a combined family income model.

Strategic Financial Planning to Avoid Repayments-As more families approach the £60,000 threshold, experts are urging parents to utilize legal methods to lower their "adjusted net income" and protect their benefits. Contributing more to a workplace or personal pension is one of the most effective ways to stay below the HICBC trigger point. For every pound put into a pension, that amount is deducted from the income HMRC sees for benefit purposes. Families can also use gift-aided charitable donations to achieve a similar result. For those who do not wish to deal with the Self Assessment tax return required by the charge, there is the option to "opt out" of the payments entirely while still filling out the claim form to ensure the lead parent continues to receive vital National Insurance credits toward their State Pension.

.svg)