Just as the European Union's Markets in Crypto Assets (MiCA) regulations take effect throughout the trading bloc, the United Kingdom intends to begin draughting a regulatory framework for the crypto business by the beginning of next year.

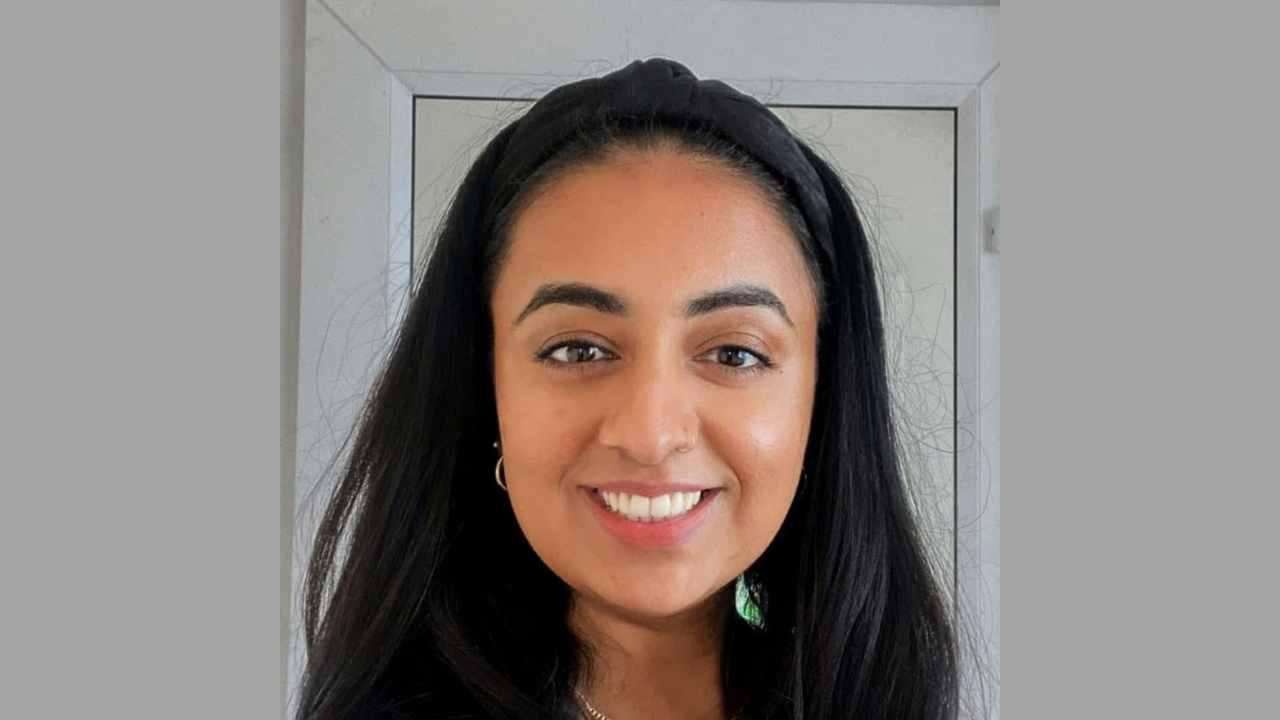

Economic Secretary Tulip Siddiq stated at City & Financial Global's Tokenisation Summit on Thursday, "We aim to engage firms on draft legal provisions for the crypto asset regime including stablecoins as early as possible next year," according to a copy of her speech that CoinDesk was able to get.

The declaration comes after months of ambiguity around the government's post-election plans for the sector. More regulations for stablecoins and staking providers are on the horizon, according to the Financial Services and Markets Act, which was implemented by the previous Conservative administration to recognise cryptocurrency as a regulated business.

Siddiq stated that the newly elected Labour administration in July plans to fully execute its predecessor's crypto proposals on the establishment of regulated activities, such as running a cryptocurrency trading platform and a market abuse regime. Stablecoins will no longer be subject to the payments regime in the United Kingdom, according to current intentions. To avoid it being viewed as a communal investment scheme, there will also be a staking carve out.

The European Union, the U.K.'s biggest trading partner, already has its crypto regulation in place. MiCA's rules on stablecoins took effect at the end of June and rest will kick in by the end of the year. Among them, the ability for crypto-asset service providers with a license in one member state being able to operate across the entire 27-nation bloc.

.svg)