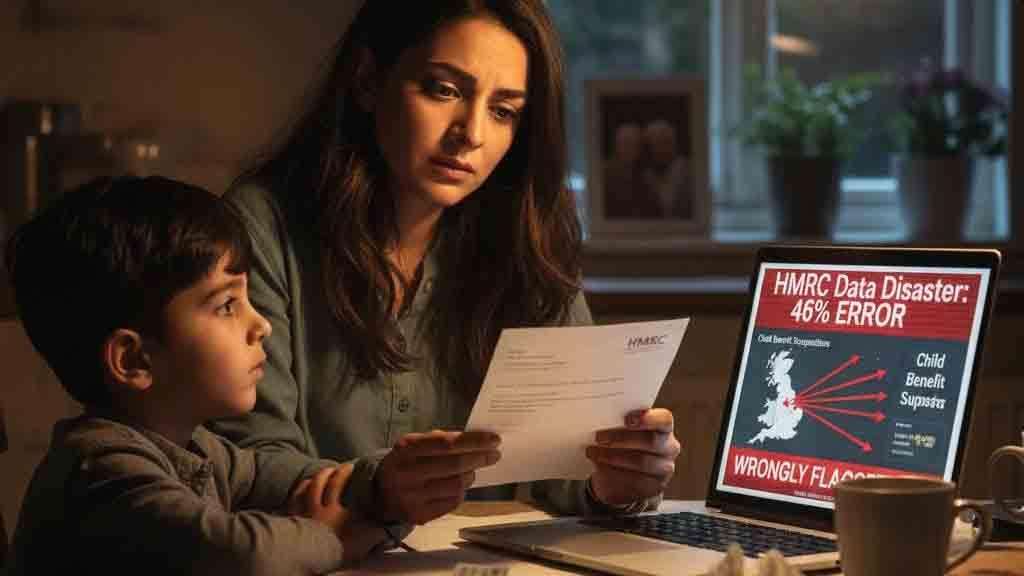

The government's high-stakes campaign against benefit fraud has stumbled dramatically, with an official trial revealing that nearly half (46%) of families targeted by the HMRC's new Child Benefit suspension policy were wrongly flagged as having emigrated. The staggering margin of error has exposed the severe unreliability of using Home Office international travel data to infer fraud, plunging the lives of thousands of UK resident parents into chaos and sparking widespread legal and political condemnation.

In a pilot scheme intended to save taxpayer money by identifying claimants who had left the UK for more than the permitted eight weeks, HMRC used Home Office records to check the residency status of Child Benefit claimants. The data, however, proved deeply flawed. Instead of catching a criminal minority, the process mistakenly stopped payments for approximately 23,500 households nationwide. Families have reported payments being suspended after short holidays, or even after booking a flight they never boarded. In an astonishing regional breakdown, the error rate in Northern Ireland soared to 78%, largely because travel through the Common Travel Area (like Dublin Airport) was misinterpreted as emigration.

The human cost of this procedural failure is immense. Parents, many of whom are dual nationals or were not born in the UK, have faced the distressing task of proving their legal residence in a country they call home. They have been forced to compile extensive documentation—from school and GP letters to old bank statements and boarding passes—to have their essential payments reinstated. The experience has left many feeling treated as criminals, with one mother noting she was "absolutely raging at having to prove that I live in my own country.”

Daily Dazzling Dawn Analysis: The Deepening Trust Crisis and The 'Trap' Anxiety

The fallout from this colossal data blunder extends far beyond the financial inconvenience, creating a profound sense of anxiety, particularly among millions of British children's parents who were not born in the UK and have close family abroad, such as elderly parents.

The fear is palpable: a short, necessary trip home to care for a sick relative or attend a family event now carries the potential for a catastrophic bureaucratic 'trap.' Parents worry that leaving the UK, even briefly and well within the legal eight-week limit, will lead to their names being flagged by the error-prone Home Office system. This could trigger a months-long suspension of vital Child Benefit payments, forcing them into an invasive and stressful process of proving their return—a task made harder when travel data is incomplete or incorrect (e.g., if they returned by ferry or Eurostar). For families already navigating the complexities of transnational life and the cost of living crisis, this administrative risk is becoming a deterrent, effectively restricting their freedom of movement and their ability to fulfil family obligations abroad.

What Could Be Happening Next

- Urgent Legal Scrutiny and Data Protection Breaches: Legal experts have already warned that the use of incomplete Home Office data for punitive purposes may constitute a breach of privacy laws. Expect parliamentary questions (PQs), and potentially legal challenges, to mount rapidly. The Liberal Democrats and Green Party have already raised concerns, demanding transparency on the scheme's business case and data protection impact assessments.

- Political Accountability: While the government aims to protect public funds (the initial pilot recovered £17 million), the 46% error rate severely undermines the credibility of the wider drive to save £350 million over five years. The Chancellor of the Exchequer will face intense pressure to justify a system with a scientifically unacceptable margin of error, which has harmed thousands of innocent families.

- HMRC U-Turn and Process Amendments: HMRC has already made an apology and announced two key changes: they will now cross-check with PAYE records before suspending payments, and will contact customers first, allowing one month to respond, instead of immediately stopping the benefit. This is a significant concession, but it does not address the fundamental issue of the flawed Home Office travel data itself. Expect them to streamline the excessive 70-question proof-of-residence form, but full trust in their data-matching capability will be irrevocably damaged.

- The Dublin Airport Exemption: Following reports that families returning to Northern Ireland via Dublin were being wrongly targeted, HMRC has stated it will no longer use data on travel through Dublin Airport to infer fraud, acknowledging its status within the Common Travel Area. This is a small victory for border communities, but it highlights the wider, systemic failure of the data-matching logic.

The government's anti-fraud crusade has become its own worst enemy, creating a chilling effect on legitimate families and shifting the burden of proof from the state onto the citizen, all based on a system experts deem fundamentally unreliable.

.svg)

.jpg)