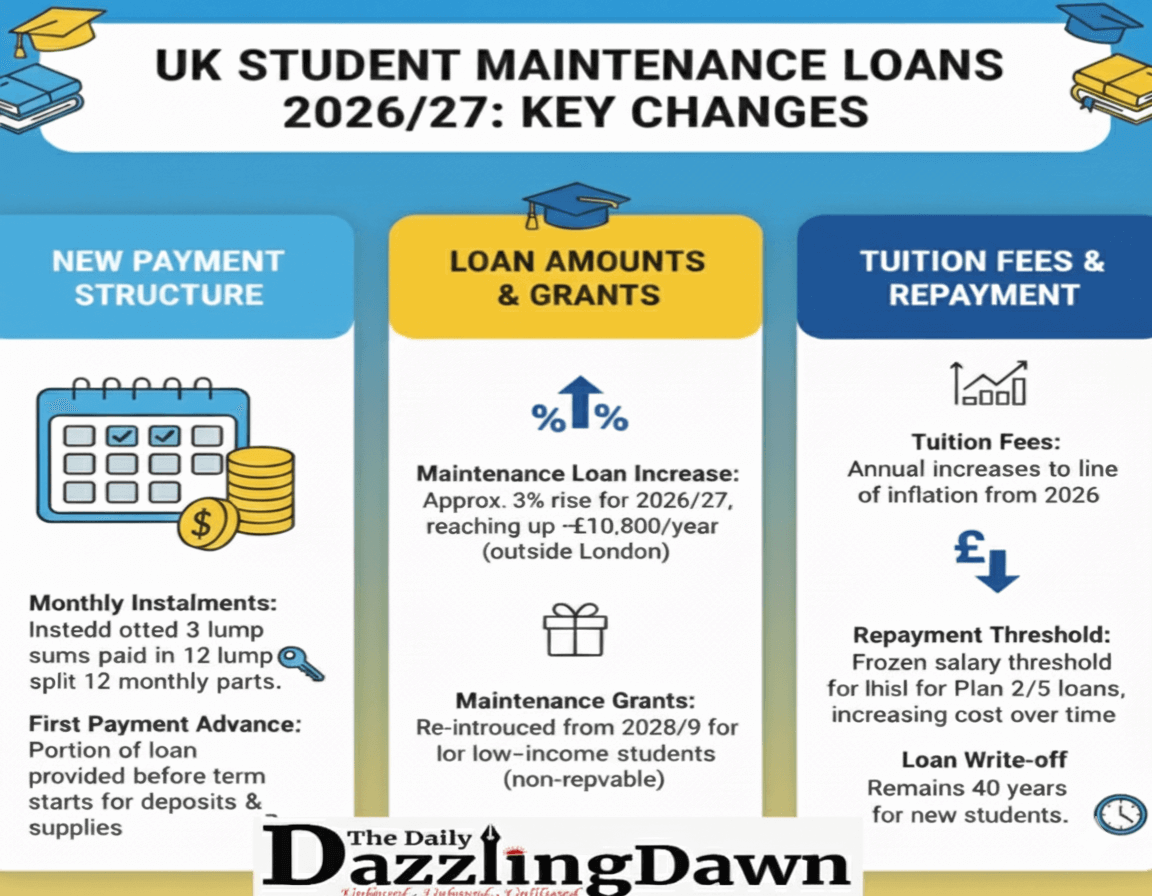

The landscape of UK higher education is facing its most significant transformation in a generation as a powerful coalition of lawmakers and student advocates intensifies pressure on the government to abandon the traditional "termly" payment system. A landmark bill introduced in Parliament this week seeks to replace the current three-lump-sum payment model with a monthly maintenance loan schedule, a move proponents argue is essential to prevent students from falling into "problem debt" during the ongoing cost-of-living crisis, Daily Dazzling Dawn understands.

Parliament Debates Shift to Monthly Payment Cycles-Led by York Outer MP Luke Charters and supported by dozens of Labour backbenchers, the Student Finance (Review of Payment Schedules) Bill is gaining rapid momentum. The proposed legislation argues that the current system—which requires students to manage thousands of pounds over four-month intervals—is fundamentally out of sync with modern financial realities. Under the new proposal, English students would receive their maintenance loans in monthly installments, mirroring the system already successfully utilized in Scotland. This shift is designed to align student income with monthly outgoings such as rent, utilities, and grocery bills, helping to eliminate the "boom and bust" cycle that often leaves undergraduates reliant on high-interest credit cards and maximum overdrafts by the middle of each term.

Advance Payments Targeted for Essential Start Up Costs-Beyond the frequency of payments, the reform package addresses the critical financial hurdle of the "pre-term" period. The National Union of Students (NUS) is aggressively backing a provision that would allow students to receive a portion of their first loan installment in advance of the academic year starting. This specific change targets the "deposits trap" faced by working-class students who frequently struggle to pay rental deposits and purchase essential supplies like laptops or textbooks before their first loan drops in late September. Supporters of the bill emphasize that starting university should be a milestone of opportunity rather than a period of financial misery, ensuring that those without parental safety nets are not disadvantaged from day one.

Rising Costs and the Return of Maintenance Grants-The push for payment reform arrives alongside a series of confirmed government adjustments to the broader student finance framework. While the government has committed to the long-awaited reintroduction of means-tested maintenance grants for the most disadvantaged students, these are not slated for full implementation until the 2028 to 2029 academic year. In the immediate term, students face a more challenging environment as tuition fees are set to rise annually in line with inflation from 2026 onwards. This follows the recent 3.1% increase which saw maximum fees climb to £9,535. To mitigate these rising costs, maintenance loan amounts for the 2025/26 and 2026/27 cycles are also being adjusted upward by approximately 3%, though critics argue these increases still lag behind the actual inflation seen in student accommodation and food prices.

Graduate Repayment Thresholds and Fiscal Tightening-Graduates are also feeling the impact of recent fiscal policy changes as the government seeks to stabilize the national economy. Recent measures announced by the Treasury have frozen the salary threshold at which graduates must begin repaying their loans. For many on "Plan 2" and "Plan 5" loans, this effectively acts as a stealth tax, as wage growth pushes more individuals into the repayment bracket while the threshold remains static. Combined with the 40-year write-off period for newer students, the long-term cost of a degree is increasing for the average borrower. With a growing group of nearly 60 Labour MPs now coordinating via a dedicated university taskforce, the pressure is mounting on the Department for Education to move beyond small adjustments and deliver a comprehensive package that addresses both the immediate cash-flow needs of current students and the long-term debt burden of graduates.

.svg)