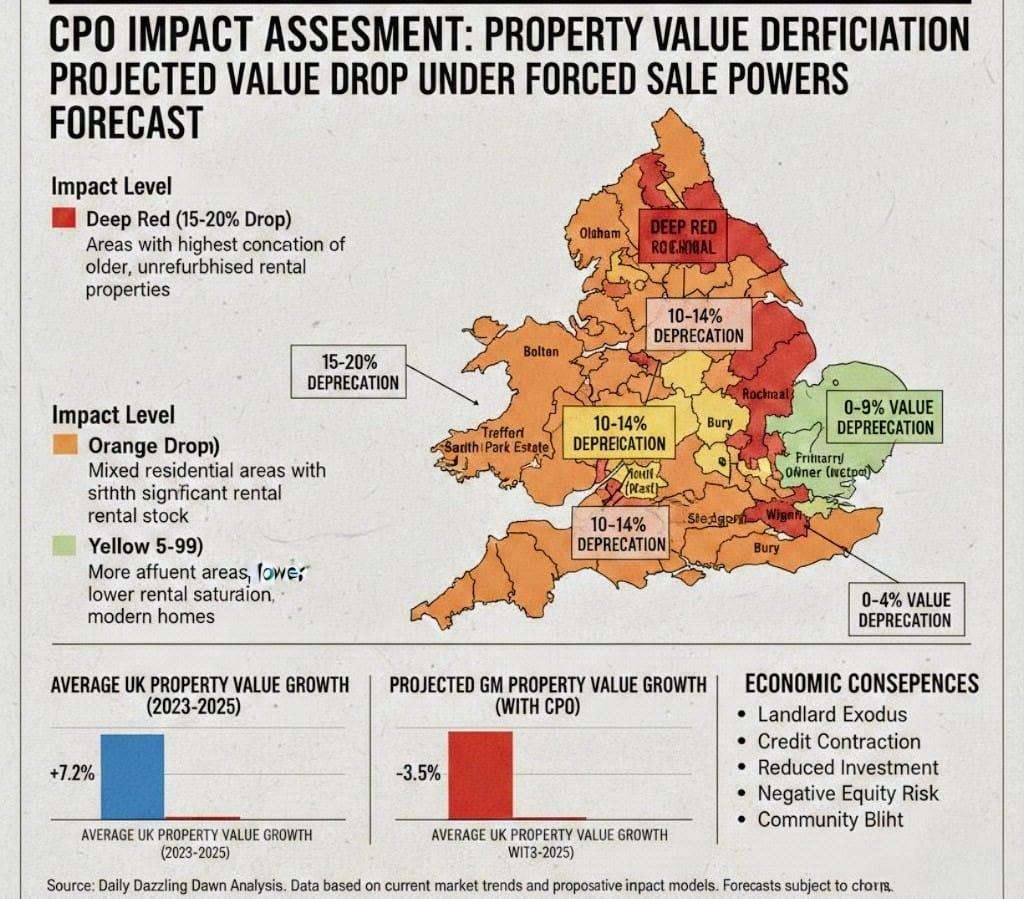

Greater Manchester Mayor Andy Burnham has ignited a firestorm within the UK property sector by demanding "radical" new powers that would allow local councils to forcibly seize private rental properties. This aggressive maneuver, framed as a solution to housing standards, is being viewed by industry analysts as a potential death blow to a rental market already reeling from a relentless legislative onslaught. By advocating for Compulsory Purchase Orders (CPOs) on properties failing the Decent Homes Standard, Burnham is introducing a level of sovereign risk that could see investment flee the UK housing market entirely, triggering a localized price collapse that threatens to go national.

The Massive Financial Burden Smothering Private Landlords

The timing of this proposal could not be more precarious for the UK’s primary housing providers. Landlords are currently staring down a staggering £26.5 billion bill required to meet the looming 2035 Decent Homes Standard deadline. This massive capital requirement is compounded by the 2030 mandate for Energy Performance Certificate (EPC) ratings of C or higher. When these renovation costs are added to the rising interest rates and the removal of mortgage tax relief, the forced sale threat from Burnham acts as a final catalyst for a mass exodus. As landlords are pushed to the brink, the resulting "fire sale" of assets is predicted to saturate the market, driving property values down and wiping out billions in household wealth.

A Systemic Risk to the Wider UK Economy

The implications of Burnham’s strategy extend far beyond the rental sector, posing a systemic threat to the broader UK economy. Real estate remains the primary engine of UK domestic wealth; a government-sanctioned move to seize assets would inevitably lead to a tightening of credit conditions. Banks, wary of the diminishing value of their mortgage books and the legal instability of the assets they lend against, may reduce lending, further stalling the property market. Furthermore, the proposal ignores the glaring hypocrisy of the public sector’s own track record. With over 71,000 council and social housing units currently sitting vacant and many failing the very standards Burnham seeks to enforce, the plan appears less like a housing solution and more like a destabilizing expansion of state power.

The Looming Contagion of Falling Property Prices

Experts warn that the introduction of CPOs for "non-decent" homes will create a "stigma effect" that drags down the value of entire communities. If a council begins seizing properties on a street, the market value of neighboring homes—including those owned by families and retirees—will likely plummet. This "Daily Dazzling Dawn" style analysis suggests that the "Next Step" in this crisis will be a sharp contraction in the supply of rental housing, as landlords exit before their assets can be seized. With fewer homes available and a climate of investment fear, the UK faces a future of stagnating growth, reduced mobility, and a property market that no longer functions as a safe haven for capital.

.svg)