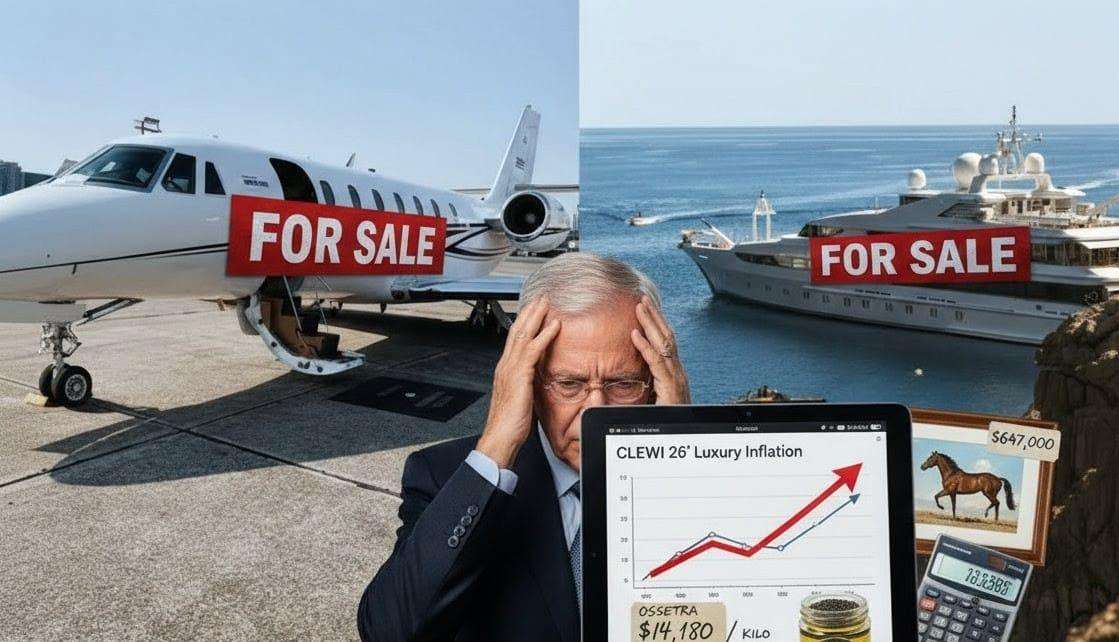

While the global middle class navigates standard inflation, a different kind of financial pressure is mounting at the very top of the economic pyramid. For the world’s 3,148 billionaires, who hold a staggering combined wealth of $18.7 trillion, the price of maintaining a "standard" ultra-luxury lifestyle has reached a breaking point. According to the recently unveiled 2026 Forbes Cost of Living Extremely Well Index (CLEWI)—a specialized consumer price index that has tracked the elite's "essentials" since 1982—the cost of the high life is rising faster than the average person's rent.

The CLEWI basket, which tracks 40 specific items ranging from Gucci loafers to private jet maintenance, indicates that the "billionaire inflation rate" is currently outpacing traditional CPI in several key sectors. For the titans of industry like Elon Musk ($342 billion) and Jeff Bezos ($215 billion), the numbers are more than just trivia; they represent a fundamental shift in the economy of exclusivity.

The Anatomy of Billionaire Inflation

The reasons behind this surge are a complex cocktail of supply chain scarcity, specialized labor shortages, and aggressive new fiscal policies. The report breaks down the year-on-year increases into startling categories. Entertainment and high-end "toys" have surged by 9.6 percent, while the cost of high-fashion staples rose by 5.2 percent. Gourmet food and household maintenance followed closely, rising by 8 percent and 4.9 percent respectively.

Specific data points from the 2026 report highlight the absurdity of the current market. A single kilogram of Ossetra caviar now commands a price of $14,180, marking a 9.2 percent jump. For those looking to upgrade their estates, an Olympic-sized swimming pool now carries a price tag of $5,816,000, up 6.2 percent. Perhaps most shocking is the 22.6 percent spike in the cost of thoroughbred horses, which now average over $647,000.

Policy Shifts and the 'One Big Beautiful Bill'

Market analysts point toward political volatility as a primary driver of these price hikes. A significant portion of the inflation in luxury assets—specifically in the equestrian and private aviation sectors—has been attributed to the "One Big Beautiful Bill" Act. This controversial legislation allows racehorse owners and private jet buyers to write off 100 percent of their purchase in the first year. While intended as a tax break, the sudden surge in demand from billionaires looking to minimize their tax liability has backfired by driving purchase prices to historic highs.

Even the world of high-stakes precision has been hit. An Audemars Piguet Royal Oak watch in stainless steel now averages $31,900, an 11.5 percent increase driven by collectors viewing horology as a "hard asset" hedge against traditional market fluctuations. Meanwhile, the cost of elite protection and lifestyle management is soaring; a one-year top-tier concierge membership has rocketed 11.1 percent to a flat $200,000 per year.

The Silver Lining: What Isn't Getting More Expensive

Despite the general upward trend, there are curious pockets of deflation in the billionaire economy. The cost of hiring an estate manager has actually dipped by 5 percent, with average salaries settling at $380,000 as AI-driven management systems begin to handle basic administrative logistics. Similarly, the price of a professional face lift has remained steady at $100,000, and an Upper East Side psychiatry session remains a "bargain" at $500 for 45 minutes—perhaps a necessary expense for those feeling the "squeeze."

Future Outlook: A Permanent Shift or a Temporary Peak?

Deep analysis suggests that this situation is unlikely to revert to 2020 levels anytime soon. The luxury market is currently undergoing a "Great Wealth Transfer," where younger heirs are shifting demand from physical goods to "experiential luxury." This transition is keeping the demand for services and travel high, even as the cost of physical assets like shotguns and yachts stabilizes.

As we move through 2026, the gap between the "merely rich" and the "ultra-wealthy" is widening. While the billionaire class can easily absorb these costs, the 11 percent increase in lifestyle maintenance suggests that even at the top, the "cost of living" is no longer a joke—it is a metric of a shifting global economy where scarcity is the ultimate currency.

.svg)