The 80-Year Low: New data reveals London housebuilding has plummeted to its lowest level since 1946. Only 4,170 homes were started last year—a staggering 72% drop.

The Affordable Housing Mirage: While the Mayor and Government tout new "agreements," construction of social and affordable homes has effectively frozen, with local authority starts down by 95%.

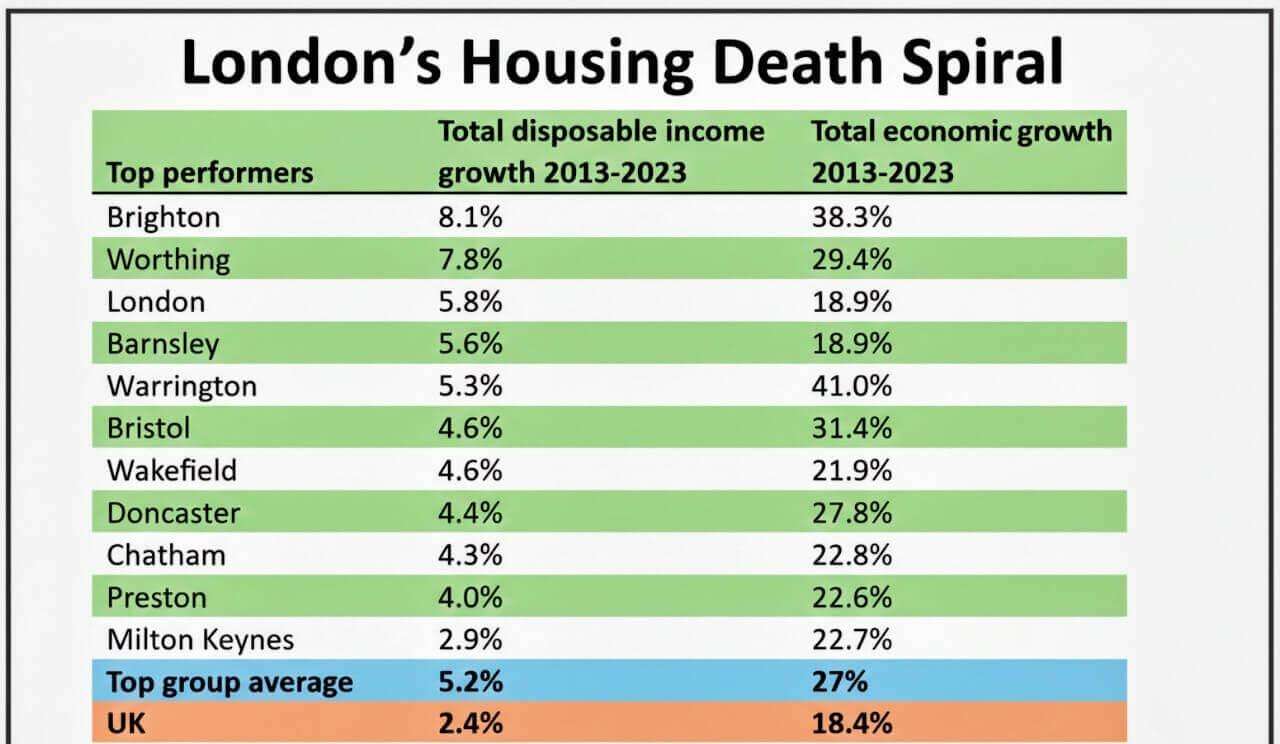

The Productivity Tax: Londoners are paying a "success penalty." Despite an 18.9% economic growth over the last decade, the average resident is no better off because housing costs act as a private tax, siphoning away nearly 20% of all disposable income.

The Brighton Overtake: In a shocking shift for 2026, Brighton has officially overtaken London as the UK’s most unaffordable city relative to local wages, proving the crisis is metastasizing across the South East.

The Hidden Cost of Prosperity- London’s status as a global economic powerhouse is becoming a hollow victory for those who keep the city running. A groundbreaking study by the Centre for Cities has exposed a widening chasm between the capital’s headline economic growth and the actual spending power of its residents. While London’s total economic output surged by nearly 19% over the past decade, the "housing tax"—the exorbitant cost of simply having a roof—is neutralizing these gains. For the young workforce, this isn't just a cost-of-living issue; it is a systemic barrier to the prosperity they were promised.

A Historic Collapse in Construction- The reality on the ground is grimmer than the official projections. As we enter 2026, London is facing a housebuilding drought not seen since the aftermath of the Second World War. Current forecasts suggest that by 2027, annual completions will drop to just 4,500 units—a fraction of the 10,000+ per year maintained consistently for eight decades. This "perfect storm" is fueled by a cocktail of high interest rates, skyrocketing material costs, and a regulatory environment that has seen 5,000 homes stalled at 51 different development sites across the capital.

The Policy Pivot: Desperation or Strategy? In a move that signals true alarm within City Hall, London Mayor Sir Sadiq Khan and Communities Secretary Steve Reed have been forced to rethink the city's "affordable" requirements. By cutting the percentage of affordable homes required in new developments to 20%, officials hope to jumpstart stalled projects. However, critics argue this is a double-edged sword: while it may move bricks and mortar, it leaves the most vulnerable Londoners further behind in a market where the average rent now consumes a record-breaking portion of the median salary.

The South East Contagion- The crisis is no longer confined to the M25. The report highlights a disturbing trend in Brighton and Worthing, where disposable incomes have grown faster than in London, yet housing supply has failed to keep pace. Brighton’s average house price is now 11 times the average salary, making it technically less affordable than the capital. This regional gridlock threatens the "new economy" firms that Brighton has successfully attracted, suggesting that without radical planning reform, the UK’s most productive hubs are effectively building a ceiling on their own growth.

.svg)